B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm utilizes debt financing,a 10% decline in earnings before interest and taxes (EBIT)will result in a decline in earnings per share that is larger than 10%,and the higher the debt ratio,the larger this difference will be.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If two firms have the same expected earnings per share (EPS)and the same standard deviation of expected EPS,then they must have the same amount of business risk.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have been hired by a new firm that is just being started.The CFO wants to finance with 60% debt,but the president thinks it would be better to hold the percentage of debt in the capital structure (wd) to only 10%.Other things held constant,and based on the data below,if the firm uses more debt,by how much would the ROE change,i.e. ,what is ROEHigher - ROELower? Do not round your intermediate calculations. ?

A) 10.31%

B) 11.59%

C) 10.43%

D) 9.15%

E) 10.54%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Other things held constant,firms with more stable and predictable sales tend to use more debt than firms with less stable sales.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The Modigliani and Miller (MM)articles implicitly assumed that bankruptcy did not exist.That led to the development of the "trade-off" model,where the firm's value first rises with the use of debt due to the tax shelter of debt,but later falls as more debt is added because the potential costs of bankruptcy begin to more than offset the tax shelter benefits.Under the trade-off theory,an optimal capital structure exists.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Monroe Inc.is an all-equity firm with 500,000 shares outstanding.It has $2,000,000 of EBIT,and EBIT is expected to remain constant in the future.The company pays out all of its earnings,so earnings per share (EPS) equal dividends per share (DPS) ,and its tax rate is 40%.The company is considering issuing $4,500,000 of 9.00% bonds and using the proceeds to repurchase stock.The risk-free rate is 4.5%,the market risk premium is 5.0%,and the firm's beta is currently 1.10.However,the CFO believes the beta would rise to 1.30 if the recapitalization occurs.Assuming the shares could be repurchased at the price that existed prior to the recapitalization,what would the price per share be following the recapitalization? (Hint: P0 = EPS/rs because EPS = DPS. )

A) $34.52

B) $27.84

C) $21.44

D) $28.12

E) $29.51

G) A) and B)

Correct Answer

verified

Correct Answer

verified

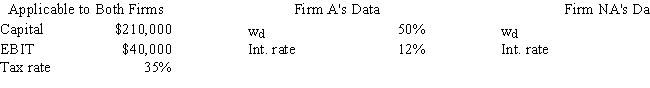

Multiple Choice

Firm A is very aggressive in its use of debt to leverage up its earnings for common stockholders,whereas Firm NA is not aggressive and uses no debt.The two firms' operations are identical--they have the same total investor-supplied capital,sales,operating costs,and EBIT.Thus,they differ only in their use of financial leverage (wd) .Based on the following data,how much higher or lower is A's ROE than that of NA,i.e. ,what is ROEA - ROENA? Do not round your intermediate calculations.  ?

?

A) 4.90%

B) 3.71%

C) 4.58%

D) 5.54%

E) 3.76%

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements best describes the optimal capital structure?

A) The optimal capital structure is the mix of debt,equity,and preferred stock that maximizes the company's earnings per share (EPS) .

B) The optimal capital structure is the mix of debt,equity,and preferred stock that maximizes the company's stock price.

C) The optimal capital structure is the mix of debt,equity,and preferred stock that minimizes the company's cost of equity.

D) The optimal capital structure is the mix of debt,equity,and preferred stock that minimizes the company's cost of debt.

E) The optimal capital structure is the mix of debt,equity,and preferred stock that minimizes the company's cost of preferred stock.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A firm's treasurer likes to be in a position to raise funds to support operations whenever such funds are needed,even in "bad times".This is called "financial flexibility," and the lower the firm's debt ratio,the greater its financial flexibility,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) A firm can use retained earnings without paying a flotation cost.Therefore,while the cost of retained earnings is not zero,its cost is generally lower than the after-tax cost of debt.

B) The capital structure that minimizes a firm's weighted average cost of capital is also the capital structure that maximizes its stock price.

C) The capital structure that minimizes the firm's weighted average cost of capital is also the capital structure that maximizes its earnings per share.

D) If a firm finds that the cost of debt is less than the cost of equity,increasing its debt ratio must reduce its WACC.

E) Other things held constant,if corporate tax rates declined,then the Modigliani-Miller tax-adjusted theory would suggest that firms should increase their use of debt.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If Congress lowered corporate tax rates while other things were held constant,and if the Modigliani-Miller tax-adjusted theory of capital structure were correct,this would tend to cause corporations to decrease their use of debt.

B) A change in the personal tax rate should not affect firms' capital structure decisions.

C) "Business risk" is differentiated from "financial risk" by the fact that financial risk reflects only the use of debt,while business risk reflects both the use of debt and such factors as sales variability,cost variability,and operating leverage.

D) The optimal capital structure is the one that simultaneously (1) maximizes the price of the firm's stock, (2) minimizes its WACC,and (3) maximizes its EPS.

E) If changes in the bankruptcy code made bankruptcy less costly to corporations,this would likely reduce the average corporation's debt ratio.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm's CFO is considering increasing the target debt ratio,which would also increase the company's interest expense.New bonds would be issued and the proceeds would be used to buy back shares of common stock.Neither total assets nor operating income would change,but expected earnings per share (EPS) would increase.Assuming the CFO's estimates are correct,which of the following statements is CORRECT?

A) Since the proposed plan increases the firm's financial risk,the stock price might fall even if EPS increases.

B) If the plan reduces the WACC,the stock price is likely to decline.

C) Since the plan is expected to increase EPS,this implies that net income is also expected to increase.

D) If the plan does increase the EPS,the stock price will automatically increase at the same rate.

E) Under the plan there will be more bonds outstanding,and that will increase their liquidity and thus lower the interest rate on the currently outstanding bonds.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Longstreet Inc.has fixed operating costs of $300,000,variable costs of $2.50 per unit produced,and its product sells for $3.70 per unit.What is the company's break-even point,i.e. ,at what unit sales volume would income equal costs?

A) 250,000

B) 232,500

C) 222,500

D) 220,000

E) 255,000

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) As a rule,the optimal capital structure is found by determining the debt-equity mix that maximizes expected EPS.

B) The optimal capital structure simultaneously maximizes EPS and minimizes the WACC.

C) The optimal capital structure minimizes the cost of equity,which is a necessary condition for maximizing the stock price.

D) The optimal capital structure simultaneously minimizes the cost of debt,the cost of equity,and the WACC.

E) The optimal capital structure simultaneously maximizes the stock price and minimizes the WACC.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You work for the CEO of a new company that plans to manufacture and sell a new type of laptop computer.The issue now is how to finance the company,with only equity or with a mix of debt and equity.Expected operating income is $690,000.Other data for the firm are shown below.How much higher or lower will the firm's expected EPS be if it uses some debt rather than only equity,i.e. ,what is EPSL - EPSU? ?

A) $1.29

B) $1.97

C) $2.23

D) $1.72

E) $1.63

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Generally,debt ratios do not vary much among different industries,although they do vary among firms within a given industry.

B) Electric utilities generally have very high common equity ratios because their revenues are more volatile than those of firms in most other industries.

C) Airline companies tend to have very volatile earnings,and as a result they generally have high target debt-to-equity ratios.

D) Wide variations in capital structures exist both between industries and among individual firms within given industries.These differences are caused by differing business risks and also managerial attitudes.

E) Since most stocks sell at or very close to their book values,book value capital structures are typically adequate for use in estimating firms' weighted average costs of capital.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The Miller model begins with the Modigliani and Miller (MM)model without corporate taxes and then adds personal taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on the information below,what is the firm's optimal capital structure?

A) Debt = 40%;Equity = 60%;EPS = $2.95;Stock price = $26.50.

B) Debt = 50%;Equity = 50%;EPS = $3.05;Stock price = $28.90.

C) Debt = 60%;Equity = 40%;EPS = $3.18;Stock price = $31.20.

D) Debt = 80%;Equity = 20%;EPS = $3.42;Stock price = $30.40.

E) Debt = 70%;Equity = 30%;EPS = $3.31;Stock price = $30.00.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The Modigliani and Miller (MM)articles implicitly assumed,among other things,that outside stockholders have the same information about a firm's future prospects as its managers.That was called "symmetric information," and it is questionable.The introduction of "asymmetric information" led to the development of the "signaling" theory of capital structure,which postulated that firms are reluctant to issue new stock because investors will interpret such an act as a signal that the firm's managers are worried about its future.Other actions give off different signals,and the end result is that capital structure is affected by managers' perceptions about how their financing decisions will affect investors' views of the firm and thus its value.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 88

Related Exams