B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Job cost sheets can provide information to managers for all of the following except

A) the cost impact of materials changes

B) the cost impact of continuous improvement in the manufacturing process

C) the cost impact of materials price or direct labor rate changes over time

D) utilities, managerial salaries, and depreciation of computers in the corporate office

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

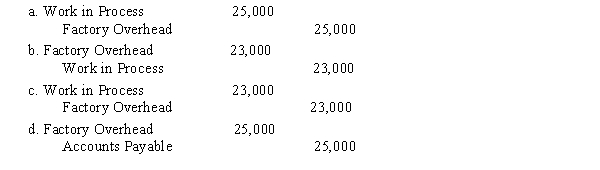

During the period, labor costs incurred on account amounted to $175,000, including $150,000 for production orders and $25,000 for general factory use. Factory overhead applied to production was $23,000. The entry to record the factory overhead applied to production is

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the costs that follow to the type of product cost (a-c) or designate as not a product cost (d) . -Machine operator

A) Direct labor

B) Direct materials

C) Factory overhead

D) Not a product cost

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Perpetual inventory controlling accounts and subsidiary ledgers are maintained for materials, work in process, and finished goods in job order costing systems.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The current year's advertising costs are normally considered period costs.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Materials are transferred from the storeroom to the factory in response to materials requisitions.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Flagler Company allocates overhead based on machine hours. It estimated overhead costs for the year to be $420,000. Estimated machine hours were 50,000. Actual hours and costs for the year were 46,000 machine hours and $380,000 of overhead. (a)Calculate the predetermined factory overhead rate for the year. (b)What is the amount of applied overhead for the year? (c)What is the amount of under- or overapplied overhead for the year? Indicate whether it is over- or underapplied.

Correct Answer

verified

Correct Answer

verified

True/False

The document that serves as the basis for recording direct labor on a job cost sheet is the time ticket.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

During April, Cavy Company incurred factory overhead as follows: Record the entry for factory overhead incurred during April.

Correct Answer

verified

Correct Answer

verified

True/False

Depreciation expense on factory equipment is part of factory overhead cost.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information below for Adams Company to answer the questions that follow.

Adams Company is a manufacturing company that has worked on several production jobs during the first quarter of the year. Below is a list of all the jobs for the quarter:

Jobs 356, 357, 358, and 359 were completed. Jobs 356 and 357 were sold at a profit of $500 on each job.

-What is the ending balance of Work in Process for Adams Company at the end of the first quarter?

Jobs 356, 357, 358, and 359 were completed. Jobs 356 and 357 were sold at a profit of $500 on each job.

-What is the ending balance of Work in Process for Adams Company at the end of the first quarter?

A) $0

B) $456

C) $3,208

D) $2,752

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sanders Inc. has applied $567,988 of overhead to jobs in the cost ledger. Actual overhead at the end of the year is $575,000. The adjustment for over- or underapplied overhead is

A) $7,012 overapplied, increase Cost of Goods Sold

B) $7,012 underapplied, increase Cost of Goods Sold

C) $7,012 overapplied, decrease Cost of Goods Sold

D) $7,012 underapplied, decrease Cost of Goods Sold

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

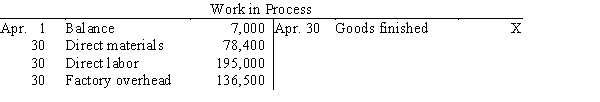

Selected accounts with a credit amount omitted are as follows:

What was the balance of Work in Process as of April 30?

What was the balance of Work in Process as of April 30?

A) $8,100

B) $35,000

C) $29,900

D) $22,900

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Job cost sheets can provide information to managers on unit cost trends, the cost impact of continuous improvement in the manufacturing process, the cost impact of materials changes, and the cost impact of direct materials price or direct labor rate changes over time.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The process cost system is appropriate where few products are manufactured and each product is made to customers' specifications.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Using the job order cost system, service organizations are able to bill customers on a weekly or monthly basis, even when the job has not been completed.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Direct labor cost is an example of a period cost.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

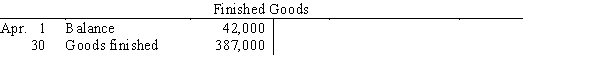

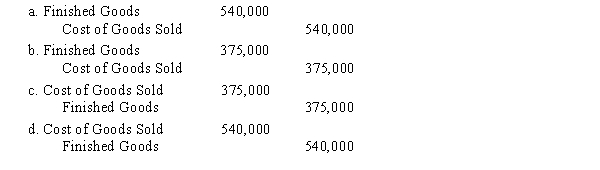

The cost of production of completed and transferred goods during the period amounted to $540,000, and the finished products shipped to customers had total production costs of $375,000. The entry to record the transfer of costs from work in process to finished goods is

Correct Answer

verified

Correct Answer

verified

Short Answer

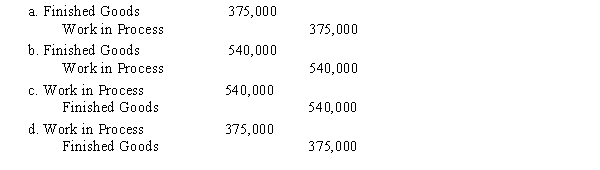

The cost of production of completed and transferred goods during the period amounted to $540,000, and the finished products shipped to customers had production costs of $375,000. The entry to record the transfer of costs from finished goods to cost of goods sold is

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 195

Related Exams