A) cash payback method

B) net present value method

C) internal rate of return method

D) average rate of return method

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

For Years 1-5, a proposed expenditure of $250,000 for a fixed asset with a five-year life has expected net income of $40,000, $35,000, $25,000, $25,000, and $25,000, respectively, and net cash flows of $90,000, $85,000, $75,000, $75,000, and $75,000, respectively. The cash payback period is three years.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company is contemplating investing in a new piece of manufacturing machinery. The amount to be invested is $210,000. The present value of the future cash flows is $225,000. The company's desired rate of return used in the present value calculations was 12%. Which of the following statements is true?

A) The project should not be accepted because the net present value is negative.

B) The internal rate of return on the project is less than 12%.

C) The internal rate of return on the project is more than 12%.

D) The internal rate of return on the project is equal to 12%.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which method for evaluating capital investment proposals reduces the expected future net cash flows originating from the proposals to their present values and computes a net present value?

A) net present value

B) average rate of return

C) internal rate of return

D) cash payback

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each definition that follows with the term (a-f) it defines. -A measure of the average income as a percent of the average investment

A) Capital rationing

B) Annuity

C) Capital investment analysis

D) Internal rate of return method

E) Payback period

F) Accounting rate of return

H) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use these present value tables to answer the questions that follow. Below is a table for the present value of $1 at compound interest. Below is a table for the present value of an annuity of $1 at compound interest. -Using the tables above, what is the present value of $3,000 (rounded to the nearest dollar) to be received at the end of each of the next four years, assuming an earnings rate of 12%?

A) $10,815

B) $7,206

C) $9,111

D) $1,908

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The process by which management allocates available investment funds among competing investment proposals is called

A) investment capital

B) investment rationing

C) cost-volume-profit analysis

D) capital rationing

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are factors that may complicate capital investment analysis except

A) possible leasing alternatives

B) changes in price levels

C) sunk costs

D) federal income tax ramifications

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

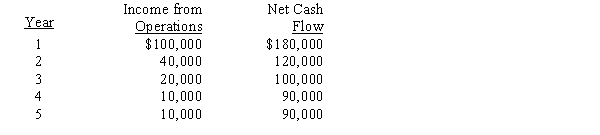

The management of Dakota Corporation is considering the purchase of a new machine costing $420,000. The company's desired rate of return is 10%. The present value factors for $1 at compound interest of 10% for Years 1 through 5 are 0.909, 0.826, 0.751, 0.683, and 0.621, respectively. In addition to the foregoing information, use the following data in determining the acceptability of this investment:?? The present value index for this investment is

A) 1.08

B) 1.45

C) 1.14

D) 0.70

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The process by which management plans, evaluates, and controls long-term investment decisions involving fixed assets is called

A) absorption cost analysis

B) variable cost analysis

C) capital investment analysis

D) cost-volume-profit analysis

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The methods of evaluating capital investment proposals can be separated into two general groups-present value methods and

A) past value methods

B) straight-line methods

C) reducing value methods

D) methods that ignore present value

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A company is considering the purchase of a new machine for $48,000. Management expects that the machine can produce sales of $16,000 each year for the next 10 years. Expenses are expected to include direct materials, direct labor, and factory overhead totaling $8,000 per year plus depreciation of $4,000 per year. All revenues and expenses except depreciation are on a cash basis. The payback period for the machine is 12 years.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

An eight-year project is estimated to cost $400,000 and have no residual value. If the straight-line depreciation method is used and the average rate of return is 5%, determine the estimated annual net income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The management of Zesty Corporation is considering the purchase of a new machine costing $400,000. The company's desired rate of return is 10%. The present value factors for $1 at compound interest of 10% for Years 1 through 5 are 0.909, 0.826, 0.751, 0.683, and 0.621, respectively. In addition to the foregoing information, use the following data in determining the acceptability of this situation:  The cash payback period for this investment is

The cash payback period for this investment is

A) 5 years

B) 4 years

C) 2 years

D) 3 years

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

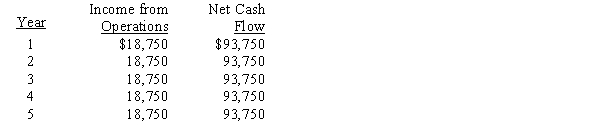

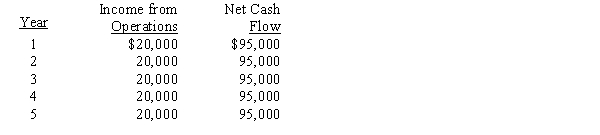

The management of Wyoming Corporation is considering the purchase of a new machine costing $375,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for five years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability of this investment:

-The expected average rate of return for a proposed investment of $650,000 in a fixed asset, with a useful life of four years, straight-line depreciation, no residual value, and an expected total net income of $240,000 for the four years, is

-The expected average rate of return for a proposed investment of $650,000 in a fixed asset, with a useful life of four years, straight-line depreciation, no residual value, and an expected total net income of $240,000 for the four years, is

A) 13.9%

B) 36.9%

C) 18.5%

D) 9.25%

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Methods that ignore present value in capital investment analysis include the average rate of return method.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The anticipated purchase of a fixed asset for $400,000, with a useful life of five years and no residual value, is expected to yield total net income of $200,000 for the five years. The expected average rate of return on investment is 25%.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A qualitative characteristic that may impact capital investment analysis is employee morale.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which method of evaluating capital investment proposals uses the concept of present value to compute a rate of return?

A) average rate of return

B) accounting rate of return

C) cash payback period

D) internal rate of return

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The management of River Corporation is considering the purchase of a new machine costing $380,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for five years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability of this investment:

-The average rate of return for this investment is

-The average rate of return for this investment is

A) 5%

B) 10.5%

C) 25%

D) 15%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 189

Related Exams