A) 9,100 units

B) 13,000 units

C) 13,227 units

D) 13,542 units

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If direct materials cost per unit increases, the break-even point will increase.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Rental charges of $60,000 per year plus $2 for each machine hour over 15,000 hours is an example of a fixed cost.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If fixed costs are $750,000 and variable costs are 60% of sales, what is the break-even point (in dollars) ?

A) $1,875,000

B) $1,250,000

C) $1,666,667

D) $1,350,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If the volume of sales is $6,000,000 and sales at the break-even point amount to $5,000,000, the margin of safety will be 20%.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Calculate operating leverage if sales are $342,000, variable costs are 58% of sales, and operating income is $42,000.

A) 6.24

B) 4.27

C) 5.25

D) 3.42

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the high-low method, calculate variable utilities costs per machine hour. ? ?

A) $0.33

B) $0.64

C) $0.50

D) $0.25

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Fixed costs are costs that vary in total dollar amount as the level of activity changes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If fixed costs are $450,000 and the unit contribution margin is $50, the sales necessary to earn an operating income of $30,000 are 14,000 units.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of a cost that varies in proportion to changes in the activity base?

A) Depreciation on machinery

B) Packaging cost

C) Factory rent

D) Insurance cost

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The systematic examination of the relationships among selling prices, volume of sales and production, costs, expenses, and profits is termed as:

A) contribution margin analysis.

B) cost-volume-profit analysis.

C) budgetary analysis.

D) gross profit analysis.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Compute break-even sales (in units) when fixed costs are $420,000, unit selling price is $66, and unit variable cost is $42.

A) 17,500 units

B) 10,500 units

C) 11,500 units

D) 20,300 units

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Vest Food Co.has the following operating data: ? The company is contemplating moving to another state where direct labor costs can be reduced, thereby reducing the unit variable cost by 10%.The state where the company currently operates has offered to reduce property taxes to encourage Vest to stay.The minimum amount of property tax savings necessary to keep the company, assuming no other changes, would be:

A) $152,016.

B) $240,000.

C) $208,696.

D) $125,217.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The fixed cost per unit varies with changes in the level of activity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Currently, fixed costs are $561,000 and the unit contribution margin is $10.What would be the break-even point in units if variable cost is decreased by $0.50 per unit?

A) 59,053 units

B) 56,100 units

C) 53,429 units

D) 60,000 units

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The graph of a variable cost per unit when plotted against its related activity base appears as a:

A) circle.

B) rectangle.

C) straight line.

D) curved line.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Variable costs are costs that remain constant in total with changes in the activity level.

B) False

Correct Answer

verified

Correct Answer

verified

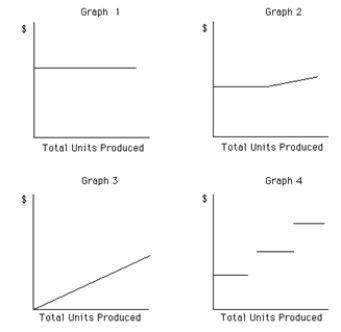

Multiple Choice

Which of the following graphs illustrates the nature of a mixed cost?

A) Graph 2

B) Graph 3

C) Graph 4

D) Graph 1

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A business has a capacity of $4,000,000 of sales, actual sales of $1,500,000, break-even sales of $900,000, fixed costs of $540,000, and variable costs that are 40% of sales.What is the margin of safety expressed as a percentage of sales?

A) 40%

B) 42%

C) 33%

D) 35%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a business sells more than one product at varying selling prices, the business's break-even point can be determined as long as the number of products does not exceed:

A) two.

B) three.

C) fifteen.

D) there is no limit.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 129

Related Exams