A) $3,500 increase

B) $3,500 decrease

C) $3,250 decrease

D) $3,500 increase.

F) B) and C)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Knowing how costs behave to change in the level of activity is useful to management for all the following reasons except for:

A) predicting customer demand.

B) predicting profits as sales and production volumes change.

C) estimating costs.

D) changing an existing product production.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Direct materials cost is an example of a fixed cost of production.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If fixed costs are $220,000 and the unit contribution margin is $25, the sales necessary to earn an operating income of $30,000 are 10,000 units.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For purpose of analysis, mixed costs can generally be separated into their variable and fixed components.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wiles Inc.'s unit selling price is $40, the unit variable costs is $30, fixed costs are $135,000, and current sales are 10,000 units.How much would operating income change if sales increase by 5,000 units?

A) $50,000 increase

B) $65,000 decrease

C) $100,000 increase

D) $50,000 decrease

F) B) and C)

Correct Answer

verified

A

Correct Answer

verified

True/False

The ratio that indicates the percentage of each sales dollar available to cover the fixed costs and to provide operating income is termed as contribution margin ratio.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Direct materials and direct labor costs are examples of variable costs of production.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under direct costing, only _____ manufacturing costs are included in the product cost.

A) variable

B) fixed

C) capitalized

D) notional

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kennedy Co.sells two products, Arks and Bins.Last year, Kennedy sold 32,000 units of Arks and 18,000 units of Bins.Related data are: ?? ? What was Kennedy's overall product's unit contribution margin?

A) $67.20

B) $70.00

C) $72.00

D) $100.00

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A production supervisor's salary that does not vary with the number of units produced is an example of a fixed cost.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

With the aid of computer software, managers can vary assumptions regarding selling prices, costs, and volume and can immediately see the effects of each change on the break-even point and profit.Such an analysis is called:

A) "what if" or sensitivity analysis.

B) vary the data analysis.

C) computer-aided analysis.

D) data gathering.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a business sells two products, it is not possible to estimate the break-even point.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on the following information, calculate fixed costs per month using the high-low method. ?

A) $12,000

B) $11,000

C) $10,000

D) $9,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Compute the break-even point (in dollars) if fixed costs are $540,000 and variable cost are 70% of sales.

A) $3,850,000

B) $1,800,000

C) $1,650,000

D) $900,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following conditions would cause the break-even point to decrease?

A) Increase in total fixed costs

B) Decrease in unit selling price

C) Decrease in unit variable cost

D) Increase in unit variable cost

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Costs that remain constant on a per-unit level as the level of activity changes are called:

A) fixed costs.

B) mixed costs.

C) opportunity costs.

D) variable costs.

F) A) and B)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

If variable costs per unit decreased because of a decrease in utility rates, the break-even point would:

A) decrease.

B) increase.

C) remain the same.

D) increase or decrease, depending upon the percentage increase in utility rates.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true about the changes in fixed cost?

A) An increase in production will result in an increase in per unit fixed cost.

B) A decrease in fixed cost will result in an increase in variable cost.

C) An increase in production will result in a decrease in per unit fixed cost.

D) A decrease in production will result in an increase in total fixed cost.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

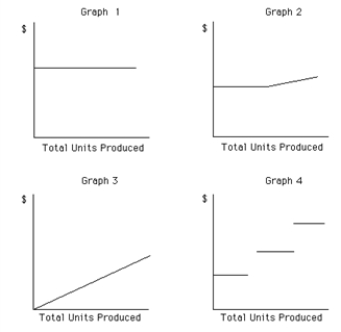

Which of the following graphs illustrates the behavior of a total variable cost?

A) Graph 2

B) Graph 3

C) Graph 4

D) Graph 1

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 129

Related Exams