A) 2, 4, 3, 1

B) 4, 2, 3, 1

C) 2, 3, 4, 1

D) 2, 3, 1, 4

1) allocate costs to transferred and partially completed units

2) determine the units to be assigned costs

3) determine the cost per equivalent unit

4) calculate equivalent units of production

5) The correct ordering of the steps is

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

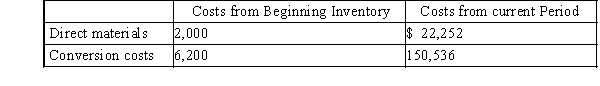

-At the beginning of the period, there were 500 units in process that were 60% complete as to conversion costs and 100% complete as to direct materials costs. During the period, 4,500 units were started and completed. Ending inventory contained 340 units that were 30% complete as to conversion costs and 100% complete as to materials costs. The company uses the FIFO process cost method. The cost of completing a unit during the current period was

-At the beginning of the period, there were 500 units in process that were 60% complete as to conversion costs and 100% complete as to direct materials costs. During the period, 4,500 units were started and completed. Ending inventory contained 340 units that were 30% complete as to conversion costs and 100% complete as to materials costs. The company uses the FIFO process cost method. The cost of completing a unit during the current period was

A) $36.19

B) $34.88

C) $35.95

D) $35.89

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mocha Company manufactures a single product by a continuous process, involving three production departments. The records indicate that direct materials, direct labor, and applied factory overhead for Department 1 were $100,000, $125,000, and $150,000, respectively. The records further indicate that direct materials, direct labor, and applied factory overhead for Department 2 were $50,000, $60,000, and $70,000, respectively. Department 2 has transferred-in costs of $390,000 for the current period. In addition, work in process at the beginning of the period for Department 2 totaled $75,000, and work in process at the end of the period totaled $90,000. The journal entry to record the flow of costs into Department 3 during the period is

A) Work in Process-Department 3 Work in Process-Department 2 375,000

375,000

B) Work in Process-Department 3 Work in Process-Department 2 570,000

570,000

C) Work in Process-Department 3 Work in Process-Department 2 490,000

490,000

D) Work in Process-Department 3 Work in Process-Department 2 555,000

555,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

The cost of materials transferred into the Bottling Department of Mountain Springs Water Company is $32,400, with $26,000 from the Purifying Department, plus additional $6,400 from the materials storeroom. The conversion cost for the period in the Bottling Department is $8,750 $3,750 factory applied and $5,000 direct labor). The total costs transferred to finished goods for the period was $31,980. The Bottling Department had a beginning inventory of $1,860. a. Journalize the cost of transferred-in materials, conversion costs, and the cost transferred out to finished goods. b. Determine the balance of Work in Process-bottling at the end of the period.

Correct Answer

verified

Correct Answer

verified

True/False

Process cost systems use job order cost cards to accumulate cost data.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Yield measures the ratio of the materials output quantity to the materials input quantity.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

The cost of energy consumed in producing good units in the Bottling Department of Mountain Springs Water Company was $36,850 and $39,060 for June and July, respectively. The number of equivalent units produced in June and July was 55,000 and 62,000 liters, respectively. Evaluate the change in the cost of energy between the two months.

Correct Answer

verified

Correct Answer

verified

True/False

The direct labor costs and factory overhead costs incurred by a production department are referred to as conversion costs.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the costs for direct materials, direct labor, and factory overhead were $60,000, $35,000, and $25,000, respectively, for 20,000 equivalent units of production, the conversion cost per equivalent unit was $6.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Just-in-time operations attempt to significantly reduce

A) profits

B) inventory needed to produce products

C) waste and simplify the production process

D) processing time

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If 16,000 units of materials enter production during the first year of operations, 12,000 of the units are finished, and 4,000 are 75% completed, the number of equivalent units of production would be 15,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each phrase that follows with the term a-e) it describes. -work centers for processing in a just-in-time system

A) cost of production report

B) equivalent units of production

C) manufacturing cells

D) yield

E) just-in-time processing

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a firm adopts a just-in-time operating environment,

A) new, more efficient machinery and equipment must be purchased and installed in the original layout

B) machinery and equipment are moved into small autonomous production lines called manufacturing cells

C) new machinery and equipment must be purchased from franchised JIT dealers

D) employees are retrained on different equipment but the plant layout generally stays unchanged

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

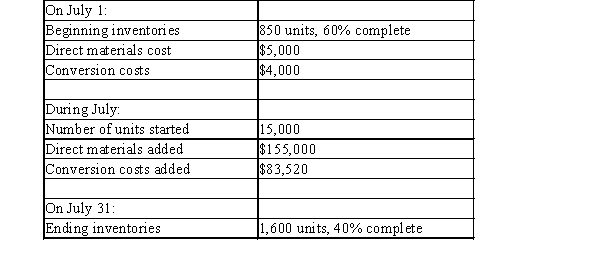

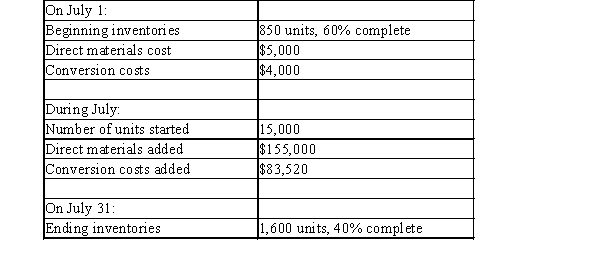

Penny, Inc. employs a process costing system. Direct materials are added at the beginning of the process. Here is information about July's activities:  -Using the FIFO method, the number of units started and completed in July was

-Using the FIFO method, the number of units started and completed in July was

A) 14,250

B) 15,000

C) 13,400

D) 15,740

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each business that follows to the type of costing system a or b) it would typically use. -Paper manufacturer

A) Job order costing

B) Process costing

D) undefined

Correct Answer

verified

Correct Answer

verified

True/False

Both job order and process cost accounting use equivalent units of production to determine costs.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Costs are transferred, along with the units, from one work in process inventory account to the next in a process costing system.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

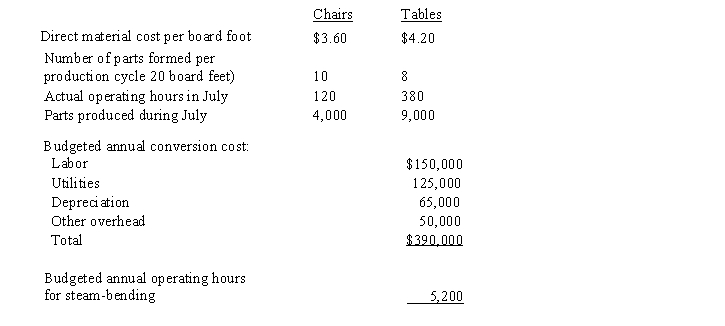

Eagle Co. manufactures bentwood chairs and tables. Wood for both products is steam-bent in the same process, but different types of wood are used for each product. Thus, materials cost is identified separately to each product. One production cycle uses 20 board feet. Labor cost is identified to the process as a whole, as is overhead cost. Data for the month of July follow:  a)Compute July's predetermined rate for the steam-bending process

b)Compute July's direct material costs for chairs and tables

c)Compute conversion costs to be applied to chairs and tables in July

d)Journalize the following entries:

1)Assignment of direct materials to chairs and tables

2)Application of conversion costs to chairs and tables

3)The transfer of completed chairs and tables to the Finishing Department. All of July's production was completed in July.

a)Compute July's predetermined rate for the steam-bending process

b)Compute July's direct material costs for chairs and tables

c)Compute conversion costs to be applied to chairs and tables in July

d)Journalize the following entries:

1)Assignment of direct materials to chairs and tables

2)Application of conversion costs to chairs and tables

3)The transfer of completed chairs and tables to the Finishing Department. All of July's production was completed in July.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Penny, Inc. employs a process costing system. Direct materials are added at the beginning of the process. Here is information about July's activities:  -Using the FIFO method, the number of equivalent units of conversion costs was

-Using the FIFO method, the number of equivalent units of conversion costs was

A) 14,400

B) 14,380

C) 14,550

D) 15,850

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The direct materials costs and direct labor costs incurred by a production department are referred to as conversion costs.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 198

Related Exams