B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The last dividend paid by Coppard Inc.was $1.25.The dividend growth rate is expected to be constant at 15% for 3 years, after which dividends are expected to grow at a rate of 6% forever.If the firm's required return (rs) is 11%, what is its current stock price?

A) $30.57

B) $31.52

C) $32.49

D) $33.50

E) $34.50

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

From an investor's perspective, a firm's preferred stock is generally considered to be less risky than its common stock but more risky than its bonds.However, from a corporate issuer's standpoint, these risk relationships are reversed: Bonds are the most risky for the firm, preferred is next, and common is least risky.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Orwell Building Supplies' last dividend was $1.75.Its dividend growth rate is expected to be constant at 25% for 2 years, after which dividends are expected to grow at a rate of 6% forever.Its required return (rs) is 12%.What is the best estimate of the current stock price?

A) $41.58

B) $42.64

C) $43.71

D) $44.80

E) $45.92

G) B) and C)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Judd Corporation has a weighted average cost of capital of 10.25%, and its value of operations is $57.50 million.Free cash flow is expected to grow at a constant rate of 6.00% per year.What is the expected year-end free cash flow, FCF1 in millions?

A) $2.20

B) $2.44

C) $2.69

D) $2.96

E) $3.25

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gere Furniture forecasts a free cash flow of $40 million in Year 3, i.e., at t = 3, and it expects FCF to grow at a constant rate of 5% thereafter.If the weighted average cost of capital is 10% and the cost of equity is 15%, what is the horizon value, in millions at t = 3?

A) $840

B) $882

C) $926

D) $972

E) $1,021

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Preferred stock is a hybrid⎯a sort of cross between a common stock and a bond⎯in the sense that it pays dividends that normally increase annually like a stock but its payments are contractually guaranteed like interest on a bond.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kinkead Inc.forecasts that its free cash flow in the coming year, i.e., at t = 1, will be −$10 million, but its FCF at t = 2 will be $20 million.After Year 2, FCF is expected to grow at a constant rate of 4% forever.If the weighted average cost of capital is 14%, what is the firm's value of operations, in millions?

A) $158

B) $167

C) $175

D) $184

E) $193

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company is expected to have free cash flows of $0.75 million next year.The weighted average cost of capital is WACC = 10.5%, and the expected constant growth rate is g = 6.4%.The company has $2 million in short-term investments, $2 million in debt, and 1 million shares.What is the stock's current intrinsic stock price?

A) $17.39

B) $17.84

C) $18.29

D) $18.75

E) $19.22

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The preemptive right gives stockholders the right to approve or disapprove of a merger between their company and some other company.

B) The preemptive right is a provision in the corporate charter that gives common stockholders the right to purchase (on a pro rata basis) new issues of the firm's common stock.

C) The free cash flow valuation model, Vops =FCF1/(WACC − g) , cannot be used for firms that have negative growth rates.

D) The free cash flow valuation model, Vops = FCF1/(WACC − g) , can be used only for firms whose growth rates exceed their WACC.

E) If a company has two classes of common stock, Class A and Class B, the stocks may pay different dividends, but under all state charters the two classes must have the same voting rights.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Connolly Co.'s expected year-end dividend is D1 = $1.60, its required return is rs = 11.00%, its dividend yield is 6.00%, and its growth rate is expected to be constant in the future.What is Connolly's expected stock price in 7 years, i.e., what is ?

A) $37.52

B) $39.40

C) $41.37

D) $43.44

E) $45.61

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carby Hardware has an outstanding issue of perpetual preferred stock with an annual dividend of $7.50 per share.If the required return on this preferred stock is 6.5%, at what price should the preferred stock sell?

A) $104.27

B) $106.95

C) $109.69

D) $112.50

E) $115.38

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Alcott's preferred stock pays a dividend of $1.00 per quarter.If the price of the stock is $45.00, what is its nominal (not effective) annual rate of return?

A) 8.03%

B) 8.24%

C) 8.45%

D) 8.67%

E) 8.89%

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Two firms with the same expected free cash flows and growth rates must also have the same value of operations.

B) It is appropriate to use the constant growth model to estimate a stock's value even if its growth rate is never expected to become constant.

C) If a company has a weighted average cost of capital WACC = 12%, and if its free cash flows are expected to grow at a constant rate of 5%, this implies that the stock's dividend yield is also 5%.

D) The value of operations is the present value of all expected future free cash flows, discounted at the free cash flow growth rate.

E) The constant growth model takes into consideration the capital gains investors expect to earn on a stock.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Decker Tires' free cash flow was just FCF0 = $1.32.Analysts expect the company's free cash flow to grow by 30% this year, by 10% in Year 2, and at a constant rate of 5% in Year 3 and thereafter.The WACC for this company 9.00%.Decker has $4 million in short-term investments and $14 million in debt and 1 million shares outstanding.What is the best estimate of the stock's current intrinsic price?

A) $31.59

B) $32.65

C) $33.75

D) $34.87

E) $35.99

G) B) and E)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

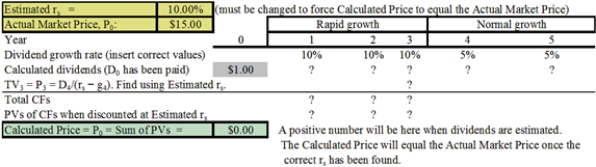

Julia Saunders is your boss and the treasurer of Foster Carter Enterprises (FCE) .She asked you to help her estimate the intrinsic value of the company's stock.FCE just paid a dividend of $1.00, and the stock now sells for $15.00 per share.Julia asked a number of security analysts what they believe FCE's future dividends will be, based on their analysis of the company.The consensus is that the dividend will be increased by 10% during Years 1 to 3, and it will be increased at a rate of 5% per year in Year 4 and thereafter.Julia asked you to use that information to estimate the required rate of return on the stock, rs, and she provided you with the following template for use in the analysis:  Julia told you that the growth rates in the template were just put in as a trial, and that you must replace them with the analysts' forecasted rates to get the correct forecasted dividends and then the estimated TV.She also notes that the estimated value for rs, at the top of the template, is also just a guess, and you must replace it with a value that will cause the Calculated Price shown at the bottom to equal the Actual Market Price.She suggests that, after you have put in the correct dividends, you can manually calculate the price, using a series of guesses as to the Estimated rs.The value of rs that causes the calculated price to equal the actual price is the correct one.She notes, though, that this trial-and-error process would be quite tedious, and that the correct rs could be found much faster with a simple Excel model, especially if you use Goal Seek.What is the value of rs?

Julia told you that the growth rates in the template were just put in as a trial, and that you must replace them with the analysts' forecasted rates to get the correct forecasted dividends and then the estimated TV.She also notes that the estimated value for rs, at the top of the template, is also just a guess, and you must replace it with a value that will cause the Calculated Price shown at the bottom to equal the Actual Market Price.She suggests that, after you have put in the correct dividends, you can manually calculate the price, using a series of guesses as to the Estimated rs.The value of rs that causes the calculated price to equal the actual price is the correct one.She notes, though, that this trial-and-error process would be quite tedious, and that the correct rs could be found much faster with a simple Excel model, especially if you use Goal Seek.What is the value of rs?

A) 11.84%

B) 12.21%

C) 12.58%

D) 12.97%

E) 13.36%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a company has a WACC = 12% and its free cash flow is expected to grow at a constant rate of 5%, this implies that the stock's dividend yield is also 5%.

B) The free cash flow valuation model for constant growth, Vop = FCF1/(WACC − g) , can be used to value firms whose free cash flows are expected to decline at a constant rate, i.e., to grow at a negative rate.

C) The value of operations of a stock is the present value of all expected future free cash flows, discounted at the free cash flow growth rate.

D) The constant growth model cannot be used for a zero growth stock, where free cash flows are expected to remain constant over time.

E) The constant growth model is often appropriate for evaluating start-up companies that do not have a stable history of growth but are expected to reach stable growth within the next few years.

G) A) and B)

Correct Answer

verified

B

Correct Answer

verified

True/False

Projected free cash flows should be discounted at the firm's weighted average cost of capital to find the value of its operations.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lance Inc.'s free cash flow was just $1.00 million.If the expected long-run growth rate for this company is 5.4%, if the weighted average cost of capital is 11.4%, Lance has $4 million in short-term investments and $3 million in debt, and 1 million shares outstanding, what is the intrinsic stock price?

A) $17.28

B) $17.70

C) $18.13

D) $18.57

E) $19.01

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Burke Tires just paid a dividend of D0 = $1.32.Analysts expect the company's dividend to grow by 30% this year, by 10% in Year 2, and at a constant rate of 5% in Year 3 and thereafter.The required return on this low-risk stock is 9.00%.What is the best estimate of the stock's current market value?

A) $41.59

B) $42.65

C) $43.75

D) $44.87

E) $45.99

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 44

Related Exams